Let's face it: financial data protection was always one of the top concerns for any organization or business. The standards and requirements for financial information management often differ from country to country. Thus, if you are dealing with client payments, you should take care of appropriate financial data security.

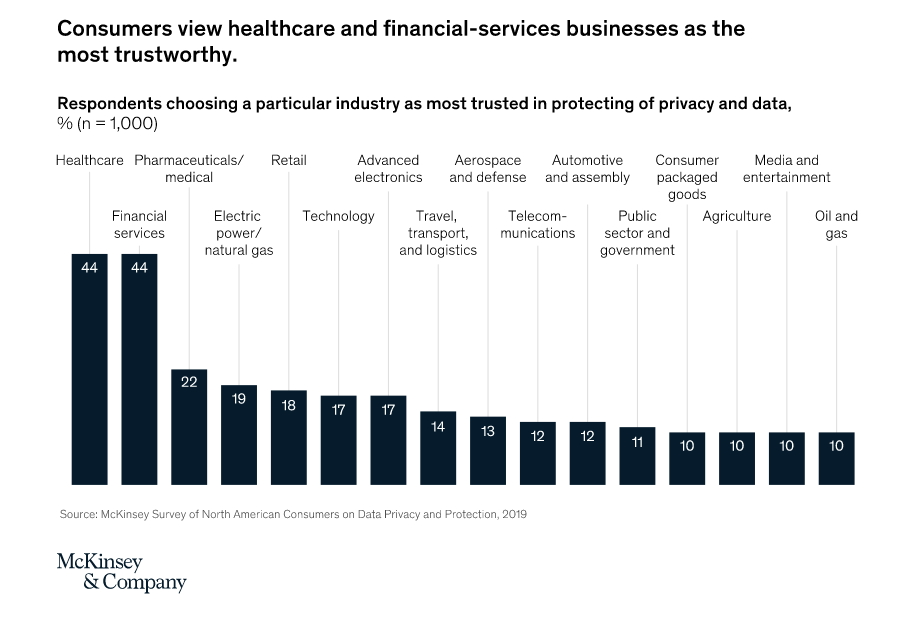

Consumer responses to McKinsey & Company survey on data management and privacy showed that trust levels could be higher. However, healthcare and financial services can boast the highest score – 44%. And note those sectors deal with highly sensitive personal data.

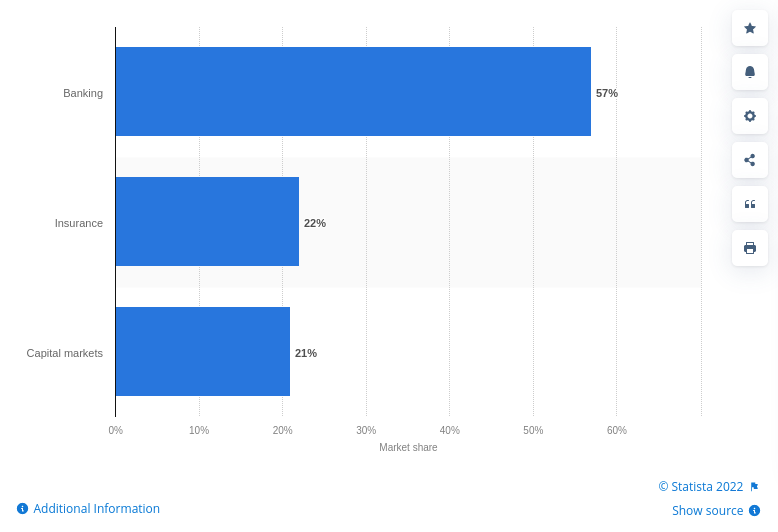

Let's throw another statistic at you from Statista: they state in their financial services companies' IT spending share worldwide by industry in 2021:

These numbers give a solid backup to the customer trust scores the financial services enjoy. In this light financial data security feels more like a sure thing than like a gamble. It’s no surprise that many business owners treat data backup like a trend that sprung from the seeds of cybersecurity. Still, there’s also strong sustainability of focus on financial data protection.

What Is Financial Data?

Financial data comprises batches or sets of information related to financial health. Company management uses these records to analyze performance and identify well- and poor-performing tactics and strategies that are better to advance or change.

What are the sources of financial statements? Here’s included

- financial position balance sheets

- income statements

- cashflow statements

- statements of change in equity

What records are included in the financial statements?

Within this notion, you have assets, liabilities, equity (net assets), revenues, expenses, gains, losses, investments by owners, distributions to owners, and comprehensive income.

Financial data vs non-financial data: What is the difference?

Financial information is advertising costs, revenue, employee compensation, assets value, routine and non-routine transactions, taxes, etc. Non-financial records are environmental impact, diversity of the workplace, and social responsibility.

Where can you find your financial data?

Your financial information can exist in different places. You may find it in balance sheets within your organization's accounting platform. Or you may hold financial data on servers located in your bank's data center. Such information can refer directly to your company’s financial health. Also, you can use it for determining whether your business is investment-worthy or complies with government-mandated rules.

Ultimately, to ensure the required compliance, companies implement different strategies that provide financial services data security. That makes you apply compliant software and protect the information behind firewalls or other existing hardware and software protection solutions. Finally, organizations intend to follow best practices regarding backing up, storing, and recovering data.

What Are the Security Vulnerabilities in Financial Services?

Financial services have adopted digital transformation that involves shifting to cloud hosting and advanced analytics and infrastructure. It’s nice to run SaaS and offer outstanding service. Still, as the survey shows, six out of ten businesses view the lack of visibility into their SaaS environments as one of their significant cybersecurity challenges.

Financial services data security often lags due to the following factors:

- financial services overwhelmed with the number of third-party apps integrated and misconfigurations

- vulnerability to a variety of cyber threats, such as account hijacking, ransomware attacks, phishing campaigns, and insider threats have the potential to cause massive data leaks

- the security-focused personnel fails to follow best practices to safeguard data

Apart from taking care of your data security, you should also add automated data backups to your financial data security strategy.

What Are the Regulatory Mandates for Financial Data Protection?

Regulatory compliance is becoming popular for financial services vendors. And this trend will likely grow due to emerging technologies like cloud computing, mobile apps, and IoT devices. Here’s a brief overview of the most popular regulatory mandates that provide financial data security standards.

PSD 2

PSD2 aims to enhance the internal market for e-payment services in the European Union. Its directives provide a comprehensive suite of regulations for payment services intending to make international payments easier and more secure. Besides, PSD2 encourages innovation and increases competition since it opens up a relevant market to fintech companies and non-bank institutions.

A crucial component of this directive is specific regulatory technical standards related to strong customer authentication (SCA). Thus, payment services providers must implement SCA for clients who make electronic payments. That guarantees secure user authentication and reduces the potential risk of fraud.

PCI-DSS

PCI DSS (or Payment Card Industry Data Security Standard) includes policies, tools, and controls required for protecting cardholder information. This standard results from united efforts made by principal credit card companies. Such organizations aim to secure payment card information better. PCI DSS applies to all merchants that accept or process payment cards and provides a comprehensive framework. Finally, it offers excellent practical guidance on the ways of securing cardholder information by following relevant security requirements.

Gramm-Leach-Bliley Act

This legal provision is also called the Financial Services Modernization Act. Its fundamental goal was to remove barriers that prohibited the consolidation of commercial banks, investment bank institutions, and insurance companies. As a result, the act allows people to manage savings and investments using one financial institution. That helps relevant combined companies perform well during times of economic turbulence. After all, complying with GLBA is a mandatory point for financial organizations, which means that all firms must adopt these policies.

GDPR

GDPR (or General Data Protection Regulation) serves as a legal framework to collect and process personal information. This act provides data subjects with greater rights and the ability to control their data. Besides, GDPR forces businesses to provide data security in financial services and meet the necessary protection measures. All companies running a business in the European Union must follow GDPR rules. That also involves companies collecting or processing personal information originated in the EU.

NYDFS

NYDFS (New York Department of Financial Services) act aims to address the growing threat of cyber crimes to financial companies. It forces them to protect their client’s information and provide the appropriate security of operations within the financial industry. This act applies to all organizations that DFS regulates, including even the branches located out of state or overseas. After all, NYDFS forces them to evaluate relevant cybersecurity risk profiles and apply a comprehensive plan for recognizing and mitigating risks.

MAS-TRM

Technology Risk Management (TRM) guidelines are issued for financial organizations by the Monetary Authority of Singapore. These guidelines contain the best practices related to technology risk management that are critical for each financial institution. They intend to ensure that financial services work with the appropriate risk management systems and maintain high-quality operating processes. Ultimately, MAS-TRM helps companies strengthen their system security, along with reliability and recoverability.

Consumer Data Right (Australia)

The Consumer Data Right (CDR) is the efficient model for open banking established by the Australian government. It provides Australians with greater control over their information. Adopting the CDR to financial organizations allows clients to obtain permission to share relevant financial information with trusted third-party companies.

The CDR was introduced in the financial industry in two phases. Firstly, it applied to the sharing of information related to credit or debit cards, along with deposit and transaction accounts. Secondly, the CDR allowed sharing of mortgage and personal loan information.

Sarbanes-Oxley (SOX)

The Sarbanes-Oxley Act was established to protect investors from different fraudulent financial reports made by corporations. This act contains new rules for bookkeepers, auditors, and company officers and provides new penalties for violating securities guidelines. Thus, the objective of SOX involves building public trust and protecting sensitive information for stakeholders. SOX applies to financial companies that manage large amounts of sensitive information.

Critical Tips for Financial Data Protection

Financial services invest in comprehensive information security frameworks that apply financial data security standards to ensure sensitive data safety. This approach is efficient since companies spend a lot of resources on data protection against cyberthreats. But, at the same time, they ignore obvious internal vulnerabilities related to business operations.

- Consider information on the move

When it comes to personnel working remotely, sensitive information is always on the move. The same situation is with third-party vendors providing crucial aspects of the financial services offered by companies. That provokes a frequent blind spot in financial data protection strategies with existing cybersecurity frameworks. That is because they focus on securing data on the organization’s network. But this approach overlooks what happens after the information has left your premises.

In this case, companies have to apply the right data security solutions. Such solutions should work even if your employees’ computers are no longer connected to the relevant network. You need to use them at the endpoint instead of the network level.

Organizations must ensure that chosen vendors follow adequate cybersecurity policies when working with third parties. That allows offering high-quality sensitive data security in financial services. For instance, companies can make data protection frameworks an obligatory requirement for each vendor.

- Pay attention to the internal threats

We care about cyber attacks but often overlook inside threads as the source of potential data leakage. Meanwhile, employees serve as the leading cause of breaches or data corruption. Plus, your team can get on the phishing hook or send sensitive data using insecure channels. They can also bypass protection measures for facilitating work, which places them at the heart of many well-known data breaches.

Combining training and specific Data Loss Prevention tools is an effective way to mitigate the risk of internal threats. Therefore, organizations need to raise awareness regarding the dangers of potential data leaks, along with further financial and reputational consequences. Also, they should educate their staff about the most common data security practices and explain social engineering tactics.

After all, your business can use DLP solutions for leveraging training efforts. For example, you may apply efficient data protection policies. Also, you have to ensure that sensitive information is not sent via insecure channels or to undesirable third parties.

- Create a financial data protection response plan

Many cybersecurity frameworks aim to secure data to ensure information breaches never happen. But when talking about cybersecurity, it is impossible to find a 100% foolproof strategy that ensures information breaches will not occur. Thus, organizations should always be prepared for relevant issues. Companies are also obliged to notify specific data protection agencies about information breaches according to data protection rules. For example, GDPR predicts that organizations have 72 hours to do that. Besides, they must inform all parties affected by a relevant breach that their information is compromised. Therefore, businesses must create an incident response plan and provide its testing. That allows reacting quickly in the case of information breaches because they have necessary notification procedures.

What Financial Data Should You Backup?

Backup strategies are often focused on central information stores, including file servers or database servers. Thus, be sure to backup your financial data like

- sales and revenue records

- accounts receivable

- payable records

- depreciation schedules

- expense receipts and invoices

- financial statements

- inventory records

- loan payment schedules

- purchase orders

Applying the appropriate cloud backup service to your security strategy will help you address data-security issues for financial services.